Agio Gold Sector Fund Fact Sheet - December 2025

Monthly fact sheet for the Agio Gold Sector Fund featuring macro commentary on gold's corrective phase, technical analysis, and fund performance data for December 2025.

Managed by Agio Capital Ltd. and advised by Legba Advisors Ltd., the Agio Gold Sector Fund (licensed June 1st, 2023) leverages a proprietary Monetary Model to provide strategic insights into the Global Monetary System. By utilizing unique Monetary Metric signals that identify outsized risk/reward opportunities, the Fund optimizes returns across short, medium, and long-term trends while comprehensively accounting for systemic risk. To maximize wealth and provide a steadfast hedge against inflation and currency devaluation, the Fund invests in a diversified mix of physical gold, ETFs, mining stocks, and derivatives, positioning it as an essential component of a modern investment portfolio.

Year to Date: 6.20% | One Year (TTM): 49.78%

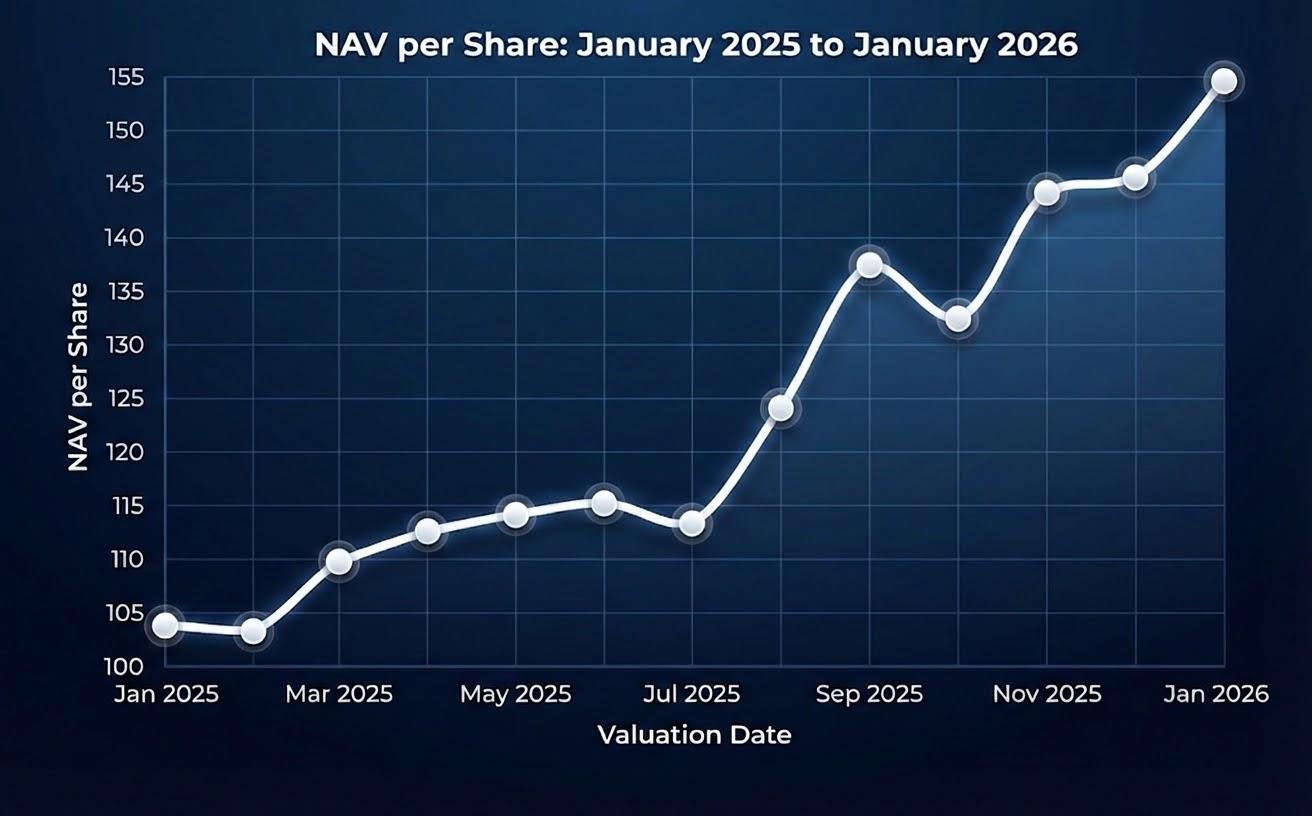

| Month | NAV | Change |

|---|---|---|

| JAN | 103.48 | +3.02% |

| FEB | 103.07 | -0.39% |

| MAR | 109.22 | +5.97% |

| APR | 112.01 | +2.55% |

| MAY | 114.00 | +1.78% |

| JUN | 115.13 | +0.99% |

| JUL | 112.75 | -2.07% |

| AUG | 123.21 | +9.27% |

| SEP | 137.43 | +11.54% |

| OCT | 132.13 | -3.85% |

| NOV | 144.23 | +9.16% |

| DEC | 145.37 | +0.79% |

| Month | NAV | Change |

|---|---|---|

| JAN | 154.37 | +6.20% |

In line with this broader market strength, the Agio Gold Sector Fund (AGSF) experienced a strong recovery in January. The Fund’s NAV increased from $145.37 to $154.37, marking a 6.20% gain for the month. On a trailing twelve-month (TTM) basis, the Fund is up 49.78%, maintaining a robust long-term performance trajectory for our investors.

January 2026 has already secured its place in the history books. Gold kicked off the year with a powerful 14% rally that briefly crossed the psychological $5,000 per ounce milestone. This surge perfectly mirrors a massive shift in global markets, where total gold demand has hit a record 5,000 tonnes annually.

Gold continues to show strong momentum, touching another all-time high in January. While the price saw some dramatic swings toward the end of the month, the underlying support from global investors remains at record levels. Total holdings in Gold ETFs have climbed to a staggering $669 billion, with the strongest buying coming out of Asia and North America.

The 5K Milestone: Crossing $5,000 is a major psychological breakout. While we saw some profit-taking at the end of the month, staying near these levels confirms gold’s status as the ultimate wealth preservation tool.

Volatility and Momentum: About half of January’s gains were driven by implied volatility. In plain English, traders are betting heavily on big price moves, creating a snowball effect of upward momentum.

The Inflation Ghost: Despite hopes that inflation would cool, several factors like new tariffs, tight labor markets, and government spending suggest inflation might stay hotter for longer than the experts predict.

Central Bank Uncertainty: With new leadership at the Federal Reserve, the market is nervous. If the Fed appears to lose its independence or struggles to control inflation, demand for gold as a hedge will likely intensify.

Usually, when stocks go down, bonds go up. However, in high-inflation environments, both can fall at the same time. This broken correlation makes traditional portfolios risky. Gold is currently acting as the essential diversifier, providing a safety net when both stocks and bonds feel the heat of rising prices and fiscal deficits.

After such a massive run-up, a short-term breather or sideways movement in price is expected and even healthy. However, the long-term outlook for 2026 remains bullish. We expect geopolitical tensions to stay high and inflation worries to resurface as we approach the US midterm elections. As long as the economy remains hot and the Fed’s path is uncertain, the environment remains highly favorable for gold.

The Agio Gold Sector Fund is managed using a proprietary monetary model to optimize entry and exit points for investments in gold and gold equity related instruments, including Physical Gold, Gold ETFs, Gold Miners, Miner Indexes, Gold Derivatives, and US Treasuries.

For those looking to gain exposure to the gold market through a regulated, professional structure, the Agio Gold Sector Fund offers clear and consistent terms:

| Detail | Value |

|---|---|

| Fund Structure | Open-ended, Professional Fund (Licensed June 1, 2023) |

| Fund Manager | Agio Capital Ltd. |

| Investment Advisor | Legba Advisors Ltd. |

| Custodian | Equity Bank Bahamas Limited |

| Minimum Investment | $5,000 initial; $1,000 for subsequent additions |

| Dealing Windows | Monthly subscriptions and redemptions (Last Business Day) |

| Redemption Notice | 5-day notice required |

| Jurisdiction | 1992 Companies Act |

Agio Capital Ltd. is a registered fund management firm located in The Bahamas, specializing in investment management services. With a focus on strategic investment approaches, Agio Capital focuses on alternative asset classes, such as gold, cryptocurrencies and other commodities, providing clients with diverse financial solutions designed to optimize returns while effectively managing risks. The firm is committed to guiding clients through the complexities of the financial markets, ensuring they achieve their investment objectives. Leveraging extensive industry expertise, Agio Capital aims to deliver comprehensive support to a discerning clientele, including corporations, private clients, and financial institutions, fostering long-term financial success.

Kevin Price offers consulting services to international corporations, private clients, and financial institutions. He is the CEO of Legba Ltd., a financial consulting firm based in The Bahamas that provides investment advisory services and risk assessment across multiple jurisdictions. With over 30 years of experience in the financial services industry since 1988, Mr. Price has worked with major banks and firms like American Express, UBS, and Gonet. His career has given him hands-on experience in the U.S., Cayman Islands, and the Bahamas, specializing in corporate banking, trading, discretionary management, and investment advisory. He has held senior management roles in these regions. Mr. Price holds an M.B.A. in finance from the University of Virginia and a B.A. in Economics from the University of Michigan. He is licensed in the U.S., the Cayman Islands, and currently registered in The Bahamas.